Life Stage: 36-50

Working Toward Your Goals

You’re balancing a range of financial priorities. Planning for retirement should be high on the list.

To help you focus, we’ve listed a few common obstacles faced by many people in your age group. You’ll also find some basic actions you can take to start — or stay — on the road to saving.

Challenges to Retirement Savings

- Sandwich Generation stress. Many people in this age group are giving financial support to both their parents and their kids. This situation can make it harder to save.

- Growing families. Building a family can bring rewards and higher costs. As people in this age group add family members, they take on bigger health care premiums and medical expenses.

- Credit card debt. Members of this age group are more likely to carry credit card debt. They also have a harder time making the minimum payment each month.

- Social Security concerns. People in the 36-50 age group are very concerned that Social Security will be gone by the time they’re old enough to receive it.

- Financial pressures. Money worries are a top source of stress for a majority in this age group.

75%

say they’re saving for retirement in 2017 — with 43% saving more than last year.*

50%

can cover monthly household expenses without difficulty.*

41%

use an independent financial planner, broker or investment advisor.*

60%

think they’re building enough savings to retire when they want to.*

| Actions You Can Take | |

|---|---|

| Sign up for your employer’s retirement plan. | Tools and calculators can help you set a savings target. Consider a double-digit contribution. The more you save now, the better your chances of reaching your goals. |

Build your retirement in multiple ways. | You can add bonuses, tax refunds or other single payments to your retirement account. If your employer’s plan offers a Roth feature, and it fits your situation, think about signing up. A Roth feature offers tax-free growth and withdrawal flexibility in retirement. |

Review your financial strategy. | Go over your insurance needs. Set up or revisit your will, beneficiary forms and estate plan. Review health care coverage to see whether a health savings account could lower your tax bill. |

Make or update your savings plan. | Create a budget and think about making retirement a top priority. Help your parents and adult children create budgets so you're aware of where they may need support. |

Focus on paying off debt. | Lowering debt can support your planning. Make extra credit card or mortgage payments whenever you can. Build an emergency fund to cover 3-6 months of expenses to help keep you from adding more debt in the face of surprise expenses. |

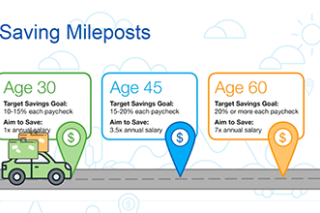

| Age 45 | |

|---|---|

| Target Savings Goal | 10-20% of each paycheck |

| Aim to Save | 3.5x annual salary |

Review Your Savings and Investments

Now is a good time to check your savings progress. You can log in to your account to see if you’re on track, or use this calculator for a quick estimate of how much you should be saving.

As you move through this stage of life, it’s also a good time to review your investment strategy. Take our quiz to see what type of mix might work for you. Then log in to change your investments accordingly.

More About Saving for Retirement