Dynamic QDIA Helps Meet Employees’ Evolving Needs

Today, 80.8% of retirement plans have a qualified default investment alternative, or QDIA.1 When employees contribute to a plan without making investment decisions, the QDIA is where their funds land. While target date funds, or TDFs, balanced funds and managed accounts are eligible investments under the QDIA rules, TDFs have captured the bulk of the assets.1

The concern is these funds primarily consider only one variable: age. This approach may ignore critical factors, such as retirement savings balance, cost of living and tax exposure — all of which become more important as individuals near retirement. Research shows 75% of people over 50 want personalized investment strategies to help them better prepare for retirement.2 The limitations of TDFs risk leaving many with portfolios that don’t align with their actual financial needs.

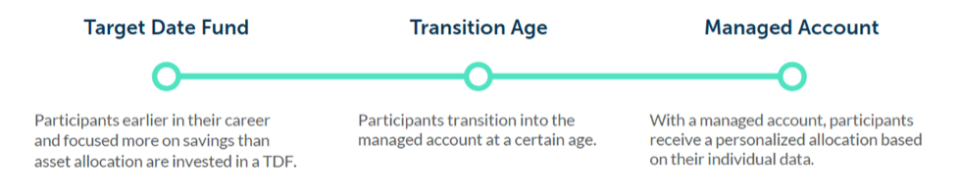

A dynamic QDIA can help meet the demand for personalization within the current QDIA environment. It combines a TDF for younger employees with a managed account for mid- to later-stage employees.

How a Dynamic QDIA Works

A dynamic QDIA defaults participants below a certain age into a TDF and defaults participants at or above that age into a managed account. The solution is based on the idea that as employee financial situations become more complex, the need for more personalized service increases. Younger participants defaulted into a TDF can elect to enroll in the managed account if they feel they would benefit from a personalized investment service.

TDF Stage

Known for their simplicity and cost-effectiveness, TDFs automatically adjust a participant’s asset allocation based on the participant’s target retirement date. TDFs can be a solution for participants who are earlier in their career and focused on savings rather than asset allocations. As participants age and their financial situations become more complex, they may benefit from an investment service that considers more than just age.

Managed Account Stage

Managed accounts offer a personalized approach to investing that doesn’t require employees to make investment decisions. A managed account provider uses employee data provided by the employer and recordkeeper to create an investment portfolio that’s customized to that employee's specific circumstances. This reduces the amount of input needed from the employee and provides them with a personalized investment allocation. Employees can further personalize their portfolio to better address their retirement and income goals by providing additional information, such as their outside assets.

Investment professionals monitor the portfolios to ensure allocations align with an employee’s retirement goals. As life circumstances change, the investment strategy can shift with these changes based on a disciplined approach. Portfolios are also adjusted to manage risk and react to market fluctuations. In addition, employees are often offered ongoing communications and call center support to help them as they prepare for retirement.

Meet Employee Needs

Dynamic QDIAs provide a right-sized default solution for a broader range of employee needs. The Standard offers a dynamic QDIA solution in partnership with Stadion Money Management, LLC, an experienced managed account provider. For more information, contact a local consultant.

SMM-2508-3

More About Sales Insights & Tools

Related Products or Services

Combine strong plans with tools and education that help employees plan for retirement.