Are MVAs Here to Stay?

Stable value funds offer retirement plan participants a low-risk investment with preservation of principal, accumulated interest and liquidity. To support the stability and competitive returns of these funds, some contracts include a market value adjustment when the fund is removed from the plan lineup.

In a higher interest rate environment, MVAs became commonplace — posing a challenge for retirement plan fiduciaries. With rates potentially on the downswing, are MVAs a thing of the past? We spoke with Mike Shamon, regional vice president, Stable Value Solutions at The Standard, about MVAs and what to expect in 2026.

What trends have you seen in MVAs?

Beginning in 2022, we saw a significant increase in MVAs because interest rates were on the rise. Higher interest rates cause the current value (market value) of bonds held in a portfolio to be worth less than what the portfolio managers paid for them (book value). In this situation, when a plan takes a distribution, it could have a detrimental impact on all participants and plans still invested in the stable value fund. To protect against this scenario and to make the remaining plans whole, insurers institute an MVA.

With a potential decline in interest rates, are MVAs a concern in 2026?

As of January 2026, we’re still seeing MVAs as high as 10% to 12%. We expect that MVAs will be on fiduciaries’ minds throughout 2026. For that reason, we are prepared to continue supporting fiduciaries and help advisors evaluate options.

How have you supported stable value investors who are facing MVAs?

At The Standard, we offer what we call an MVA equalizer to both recordkeeping and investment-only clients. With an MVA equalizer, The Standard pays the MVA (or a portion thereof) assessed by the prior stable value provider. Over time, this payment by The Standard will be recouped through offering a lower crediting rate. The Standard is different in that we offer several different MVA solutions to consider, based on what is best for the plan and their goals.

Do all stable value providers offer MVA equalizer solutions?

Many do, but MVAE provisions across providers can be very different. It’s important to look under the hood and ask a lot of questions about the recovery and repayment process, portability of the fund, how much of the MVA will be covered, whether the MVA will be absorbed into the provider’s pool of assets and whether the provider adheres to ERISA’s Prohibited Transaction Exemption.

What is ERISA’s Prohibited Transaction Exemption and how does it pertain to MVAs?

The ERISA Prohibited Transaction Exemption allows us to provide an interest-free “loan” to the plan to cover an MVA that the plan might be responsible for paying back. Our actuaries track repayment of that “loan”, and we can provide reporting on repayment status at any time.

At The Standard, the MVA is not locked into a recovery period. If the MVA is paid off sooner than the estimated recovery, we will move participants into the higher rate as soon as possible.

Despite MVAs, are stable value funds a compelling investment?

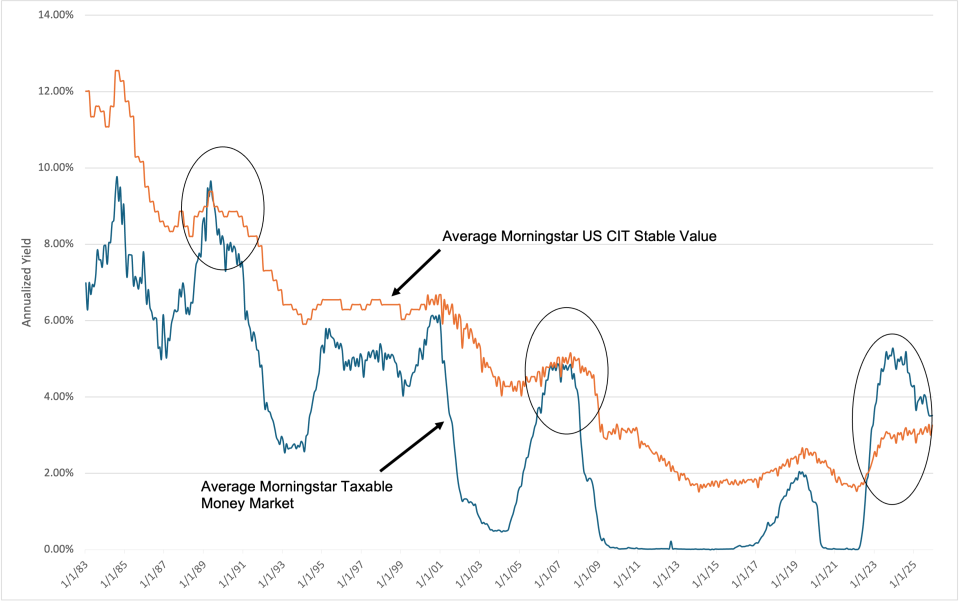

We believe stable value is always in season. Recent interest rate volatility temporarily made money market funds look more attractive. However, money market funds have historically outperformed stable value funds only during periods of rapidly rising rates. In the past 30 years, there have been only a handful of periods when average money market fund yields have approached those of stable value funds, where only one actually surpassed those rates. The graph below details the paths that both stable value and money market funds have taken over the last 40+ years.

As rates decline, stable value funds represent a compelling alternative to money market funds, whose yields closely follow the federal funds rate. With their longer maturities, stable value funds can potentially offer better returns and more stability for retirement plan sponsors, compared with money market funds. Historically, stable value funds have been more consistent and less volatile, making them an option to consider for people close to retirement.

Average Morningstar US CIT Stable Value Yields vs. Average Morningstar Taxable Money Market Yields

1983-2025

For more information on stable value investing, contact us.

More About Sales Insights & Tools

Related Products or Services

Provide investment security and growth with our conservative, risk-controlled approach, which guarantees principal and interest.