Enhance Financial Protection as Incomes Rise With GSI IDI

Employees, including high-earners and executives, are experiencing record wage growth. It’s a time of incredible change: the Great Resignation continues, inflation is a daily discussion and after more than two years of a pandemic, people are reprioritizing their lives.

According to Fortune.com, executive income hit record highs for the sixth straight year.1 Across the income spectrum, U.S. companies are increasing salaries and frequency of pay raises to attract new employees and keep valued ones.

Along with inflation, we’re seeing a growing job market with low unemployment. The dynamic of lower labor participation, or worker shortages, helps push wages higher. But employees may look beyond salaries during a recruitment process or decision to stay with present employers. They may closely consider benefits, culture and rewards that enhance their personal well-being.

Fundamental Income Protection

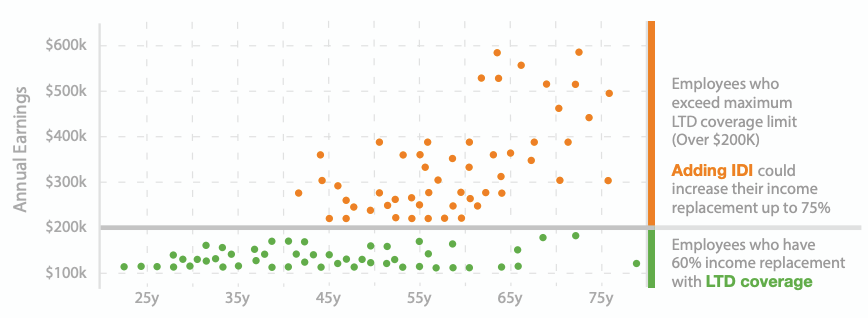

Most companies offer group long term disability benefits.2 The coverage helps reduce the risk of financial setbacks for employees. LTD typically provides income replacement for 60% of an employee’s salary and may have a maximum monthly benefit. It’s a solid, reliable foundation base for income replacement for most employees.

Step Up With GSI Financial Safeguards

Current inflation may continue to reduce the buying power of recent salary gains. With this in mind, your clients and their employees are looking for additional ways to protect their financial interests.

For leadership and executives, LTD provides a first level of income replacement. However, highly compensated employees may have less than 60% of income protection. This is a substantial gap in their income protection.

|

An LTD plan typically replaces 40-60% of income for most employees. As represented by the orange dots in this sample analysis, an LTD plan’s maximum benefit may leave income protection gaps for high-earning employees. And most LTD plans don’t cover bonus income.

These gaps in protection increase when you take record salary levels into consideration. Adding GSI IDI to LTD coverage can significantly reduce income protection gaps ― and financial risk for high-earning employees. And you can help tailor plans to meet clients’ specific needs, such as higher maximum benefits or longer benefit periods.

With a GSI IDI plan, employers pay for individual policies for each employee and can qualify for discounted rates. Employees apply without medical underwriting. And an organization can also cover bonuses or incentive pay under their plan.

Personalize Income Protection With GSI IDI

Clients can further personalize coverage for their high-earning and executive employees by adding important coverage.

For instance, under Platinum Advantage GSI IDI, employers can add the Own Occupation Rider. This amends the definition of total disability. With so highly specialized employees, they may be able to collect total disability benefits if they’re unable to perform the duties of their regular occupation but earn income from another job.

You can also ensure coverage increases along with employee salaries. Take advantage of GSI Annual Renewal Increases. With this feature, The Standard reviews an employer’s plan along with current LTD coverage and compensation levels. This allows employees’ coverage to grow with their income.

During this time of economic change, your clients can focus on ways to retain top talent and highly compensated earners. Finding the right benefit solutions that offer financial security and income protection are important to employees.3

The Standard’s GSI IDI offers personalized income protection solutions for your clients.

For more information on GSI IDI coverage and solutions, contact your GSI Sales Representative.

For Producers Only