Deliver Steady Growth – Even in Unpredictable Markets

Today’s market can be unpredictable, and many clients are seeking certainty — especially when it comes to preserving and growing their retirement savings. That’s where the Enhanced Choice Index Plus, or ECI Plus comes in — offering strategic solutions for your clients’ retirement savings.

ECI Plus is a fixed index annuity, or FIA, that offers a game-changing feature: Trigger Rate Plus crediting strategy on the S&P 500® Dynamic Intraday TCA Index. This strategy provides growth when index performance is zero or negative and even more potential when markets rise. It’s a powerful tool to help meet client needs in all kinds of market conditions.

What Makes Trigger Rate Plus Different?

This crediting strategy supports clients who seek stability and opportunity. Unlike traditional crediting methods, Trigger Rate Plus incorporates built-in growth opportunities across various market scenarios. This includes rates that are guaranteed for the entire five-, seven- or 10-year period.

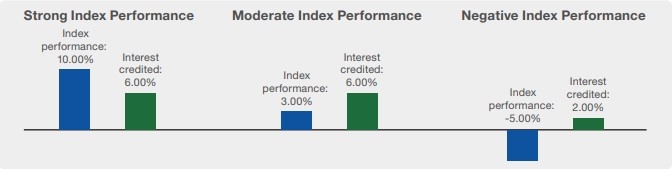

- If the index performance is zero or positive: Clients earn a guaranteed Trigger Rate.

- If the index performance is negative: Clients still receive a Guaranteed Earnings Rate.

Let’s look at a scenario where the Trigger Rate is 6.00% and the Guaranteed Earnings Rate is 2.00%:

This kind of downside protection is unique in its ability to credit a guaranteed rate even when the index declines. A strategy like this may appeal to your risk-averse clients. As one industry expert recently put it, "As trivial as how it might seem, a producer being able to explain that the worst-case scenario in a year is a low-level return, like 1%, rather than a goose egg is a big deal.”1

Enhanced Choice Index Plus Annuity

ECI Plus is a single premium deferred index annuity, backed by over 100 years of financial strength and nearly a century of A-ratings.² It’s recent enhancements include:

More Rate Guarantees:

- Up to 10 allocation options with guaranteed rates for five to 10 years, depending on the selected strategy.

- Includes fixed interest crediting, now enhanced with a multi-year rate guarantee.

New Index Option:

- S&P 500® Dynamic Intraday TCA Index

- Designed to provide exposure to the S&P 500 by using an intraday risk control mechanism with a target volatility of 15%.

New Crediting Strategies:

- Trigger Rate, Trigger Rate Plus, Locked Cap Rate and Locked Trigger Rate in addition to traditional Cap Rate and Participation Rate options.

Connect with your National Marketing Organization to explore how the ECI Plus with Trigger Rate Plus crediting strategy can enhance your product portfolio and help support your clients’ long-term financial goals.

More About Sales Insights & Tools

Related Products or Services

Doing business with The Standard is good for you and your clients. Our annuities offer innovative product design, desirable rates, competitive compensation, high industry ratings and excellent service.