Consider yourself fortunate if your employer offers Platinum Advantage GSI Individual Disability Insurance. This coverage helps you pay your bills and support your current lifestyle if you are injured or sick and cannot work.

Platinum Advantage GSI offers these advantages:

- Discounted premium rates

- No medical questions

- Coverage you can take with you if you leave your employer

- Identical rates for women and men

- Coverage up to age 99

- Coverage that can keep pace with salary increases throughout your career

Protect Your Lifestyle With Higher Income Protection

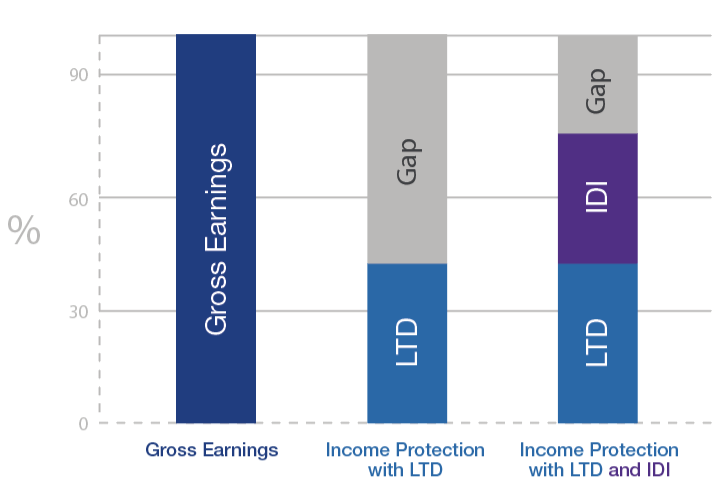

You may already have long term disability insurance through your employer. It's designed to replace up to 60% of your base salary, but it's often capped at a lower monthly amount. When you combine Platinum Advantage GSI individual disability insurance with your LTD coverage, you can raise your coverage amount to a higher level. And individual disability insurance covers bonuses, distributions and other incentive income.

How IDI Can Help Reduce the Coverage Gap

This chart assumes an LTD plan of 40% income replacement to a $10,000 monthly plan maximum, coordinating with an IDI plan design of 75% replacement to a $10,000 monthly plan maximum, for a combined coverage maximum of $20,000 between plans.

This graph is intended for illustrative purposes only.

Family Care Benefit

The exclusive benefit helps you take time away from work to care for a family member with a serious health condition.1 It provides a monthly benefit amount if you work at least 20% fewer hours and experience an income loss of 20% or greater.