Save for the Future With a Deferred Annuity

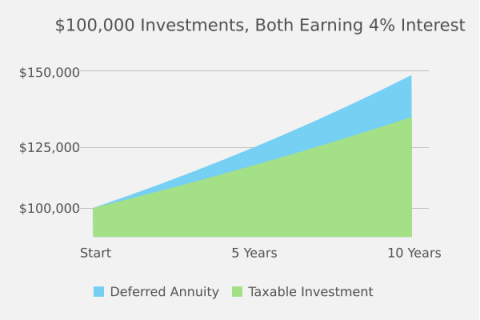

A deferred annuity is a secure way to save for a future goal like retirement. The money you put in earns tax-deferred interest until withdrawals are made or regular distributions start. So you’ll also benefit from triple-compounding: earning interest on principal, interest on interest and interest on tax savings.

The Power of Choice

Decide Which Type of Annuity Fits Your Goals

You can choose from two types of deferred annuities: fixed or indexed. Fixed-rate annuities offer a locked-in guaranteed interest rate for a set number of years. Indexed annuities offer gains based on the performance of an index, like the S&P 500®, while providing similar guarantees to traditional fixed annuities.

Flexible Withdrawal Options

Our deferred annuities offer several ways to withdraw funds during the surrender-charge period without ending the contract or paying surrender fees. These options vary by annuity, but may include:

- 10 percent annual withdrawals

- Payments of interest earnings

- Waivers for nursing home residency or terminal conditions

- IRS required minimum distributions

- Substantially equal periodic payments

- Annuitization

- Death benefits

Choose How You Pay

You can purchase deferred annuities with a single premium or multiple premium payments.

You May Be Able to Convert Your Annuity

Most states allow you to exchange your deferred annuity for an annuity that produces guaranteed income payments.

Make Your Money Last

If you have a lump sum of money, you can convert it into a safe and steady income stream that lasts for years — or even the rest of your life.

How Can I Buy an Annuity?

Your financial advisor can help you purchase annuities from The Standard. Don’t have an advisor? We can connect you with an expert who can answer your questions and provide the latest rates.