What Millennials Value Most and How to Advise Them

By 2020, Millennials and Gen Xers will own more than 60% of the country's small businesses, up from about 38% today, according to Morgan Stanley and BCG estimates (Forbes.com, July 2016).

Quick, picture a Millennial. If a couch-surfing college student came to mind, think again. The youngest is now of legal drinking age in most states and the oldest is approaching 40. We've reached “peak Millennial.” The bulk of this demographic is grown up and beginning to settle down — in their generation's unique style.

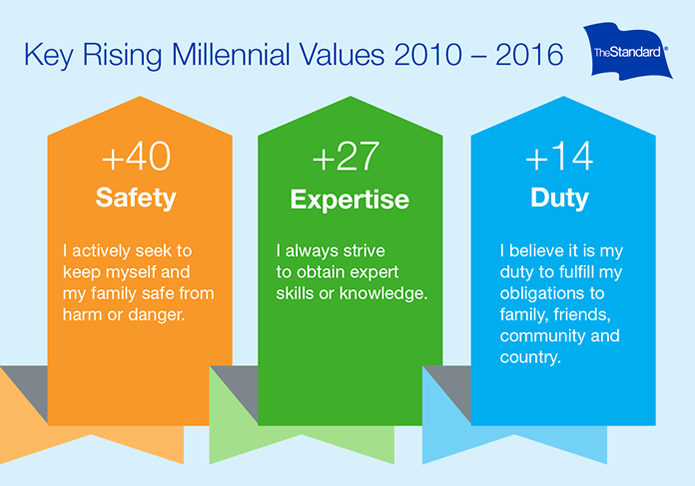

Their values might surprise you, too. Loyalty, success and family are in the top five. Safety, expertise and duty are on the rise as key values. Those values align with Millennials' interests in financial planning and purchasing insurance. Equally relevant to IDI sales, by 2020, Millennials and Gen Xers will own more than 60 percent of the country's small businesses, up from about 38 percent today. That's an opportunity indeed.

CEB Iconoculture's Values and Lifestyle Survey2 finds that:

- 19% of Millennials have life insurance today

- 26% have property and casualty coverage

- 22% have a personal retirement savings plan

Millennial Snapshot

Population Size: 77.5 million1

Age: 22-39 in 2017 (b. 1978-1995)

Age Breaks:

Younger (b. 1986-1995)

Older (b. 1978-1985)

Buying Power: $2.26 trillion1

Median Household Income: $65,021

Married or Partnered: 60%2

Parents (of children in the home): 47%2

Employed (full-time/part-time): 56%/17%2

Urban/Suburban: 41%/42%2

Graduated College: 45%2

Source: CEB Iconoculture Values and Lifestyle Survey, October 2016.

Platinum Advantage and the Millennial Mindset

Now let's look at how Platinum Advantage aligns with this group's values and preferences — and how to advise Millennials on income protection.

Flexibility → Platinum Advantage. Millennials have grown up with virtually unlimited options and the freedom to choose. Think online shopping, streaming music, TV and movies on demand ... you get it. Platinum Advantage lets you and your customer pick and choose the options and riders that fit current careers and big dreams.

Loyalty + Family → Family Care Benefit. Nearly 40 million Americans provide unpaid care to an adult friend or relative, and of those caregivers, Millennials already make up nearly 25 percent (AARP.org, 2015). As their Boomer parents retire and age, young adults will take on more caregiving responsibilities. Appeal to them with the Family Care Benefit, which can help them replace income lost while caring for a family member with a serious health condition.

Success + Safety → Benefit Increase Rider. This innovative Platinum Advantage rider allows policyholders to increase their monthly benefit every three years to keep pace with their rising incomes.

Small Business Ownership → Enhanced Residual Disability Rider. It's designed for small business owners and other professionals who may not see an income loss immediately after becoming disabled.

Authenticity, Honesty, Expertise → You and The Standard. Millennials seek expertise and brands that deliver an authentic experience they can trust. Your expertise, partnered with The Standard’s track record and compassionate, first-person customer service, offers a combination they can count on.

Review our infographic for more fast facts and tips: Target Millennials for IDI Sales.

Source: CEB Iconoculture Values and Lifestyle Survey, October 2016

For Producers Only