Boost Participant Contributions With Step-Up Savings

Keeping up with retirement savings can be difficult. Participants often elect a contribution rate and never change it. Unless the plan has an automatic contribution arrangement, or the participant is in a managed account that offers automatic increases, contribution rates often remain stagnant.

This is why we’re introducing a service that allows participants the option to elect an annual incremental increase to their deferral percentage.

Step-Up Savings is an optional service plan sponsors can add to the Personal Savings Center for their employees. If selected, participants can turn on this service during enrollment or any time after. They can also turn it off anytime. There is no plan amendment required or extra cost to add Step-Up Savings. This service is available for both pre-tax and Roth contributions.

A Step-Up Savings Scenario

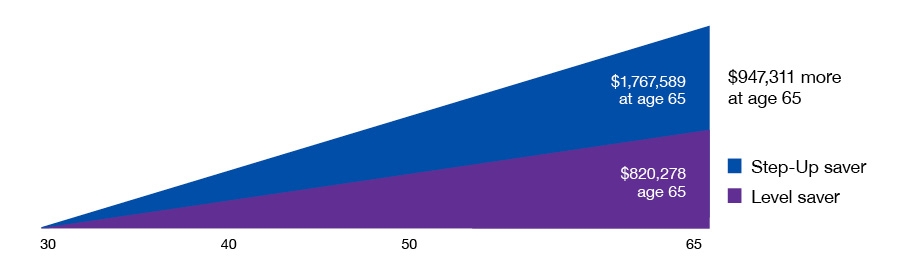

Assume a participant makes $65,000 per year and wants to opt into the Step-Up Savings program. Here’s what their retirement savings may look like at age 65:

Level saver contributes 6% each year from age 30 to age 65. The Step-Up saver starts at 6% and increases 1% each year until it reaches a contribution rate of 15%. Once it reaches this rate, Step-Up saver then remains at 15% until age 65.

The graph assumes a $65,000 salary adjusted for 3% annual inflation and a 7% annual investment return net of any fees or expenses. But the investment rate shown above may not reflect current market conditions. Investments fluctuate and may be worth more or less than originally invested. This is a hypothetical example for illustrative purposes only. Not specific to any plan or investment.

Step-Up Savings can help participants who may struggle with keeping tabs on their retirement portfolio. For more information, check out our Step-Up Savings Guide and FAQ or contact your representative.

More About Retirement Readiness