What does Generation Z want from employee benefits — and from employers? This age group's expectations are less about quick, radical change and more about gradual shifts and partnership.

Employers are in a good position to offer Gen Zers many of the benefits they value — because employers already do. Our research shows Gen Z prioritizes bread-and-butter programs — like medical coverage, retirement plans and life insurance — over newer offerings like pet insurance.

This means HR leaders can avoid costly benefits package overhauls. But it doesn't mean the approach to benefits for this generation needs no refining.

Many of the Benefits Gen Zers Want Are Already There

In looking at how Gen Z prioritizes benefits and how HR decision-makers think Gen Z ranks them, we found some notable differences.

| Gen Z’s Top 5 Benefits in Priority Order | HR Leaders’ Perception of Gen Z’s Top 5 Benefits in Priority Order |

|---|---|

| 1. Health/medical insurance | 1. Health/medical insurance |

| 2. Paid family and medical leave | 2. Flextime |

| 3. Retirement savings plans | 3. Flexible work location/Student loan repayment (tied for third place) |

| 4. Life insurance | 4. Mental health days |

| 5. Emergency savings accounts/Mental health days (tied for fifth place) | 5. Mental health services |

Financial Goals Gap

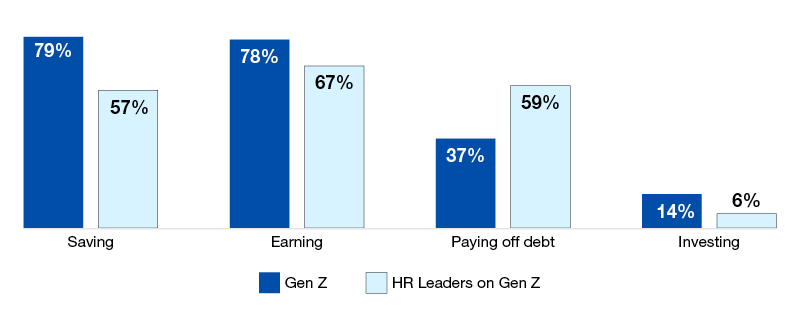

One likely driver of the disconnect on benefits preferences between Gen Z and HR leaders is a gap in understanding Gen Z’s financial goals.

Earning and saving are more important to Gen Z than many HR leaders realize. And paying off debt is less important to this age group than many HR decision-makers think it is.

Gen Z's Financial Goals

A Benefit Hiding in Plain Sight

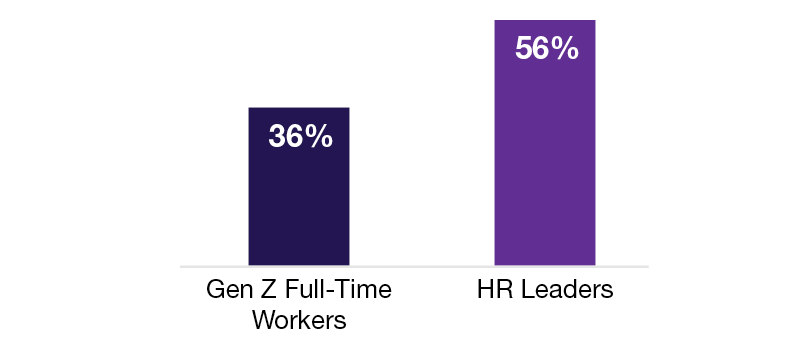

Retirement support is an example of a benefit that’s often available — but one that Gen Z may not be aware of. Thirty-six percent of full-time Gen Z workers say their employer provides a lot of support for retirement saving, compared with 56% of HR leaders.

That 20-percentage-point difference suggests Gen Z has the support for retirement plans it wants — but doesn’t always know it.

"My company helps workers a lot via a retirement savings plan."

Speaking Gen Z

Our data suggests HR leaders should focus on helping Gen Z understand that many of the benefits they want are already there for them. Adjusting messages and communicating in ways this age group prefers — such as with video and internal influencers — will likely boost retention and engagement of Gen Z talent. Speaking to Gen Zers via platforms and media they find meaningful should also strengthen the sense of partnership they seek with their employers.

Shifting Expectations

Wanting employers to help them solidify their financial security isn't unique to Gen Z. But this cohort is looking for support historically provided by banks, families and even government. Gen Z also favors benefits providers willing to respond to societal challenges, expecting much more from carriers than it does from other businesses.

As Gen Zers prepare for the future, they’re looking for employers and carriers to partner with them — through benefits and help with financial literacy. That starts with truly understanding what this generation wants. It also means making benefits communication relevant.

Carriers that build Gen Z’s loyalty through targeted messages and benefits enhancements will have an advantage. Employers working with these carriers will also gain by attracting and retaining this generation’s talent.

Dig Deeper

For a more in-depth look at what we learned, explore these position papers.